India Automotive Hub: Japan’s Auto Giants Are Ditching China — and Betting Big Somewhere Unexpected

India Automotive Hub is rapidly becoming the world’s next automotive manufacturing powerhouse. Toyota, Honda, and Suzuki are spearheading a massive strategic pivot, announcing over $11 billion in new investments to dramatically expand production capacity in India. This move is directly tied to Japanese automakers reducing investment in China, as India offers a combination of lower manufacturing costs, a vast labor pool, and crucial tariff exemptions for exports to the U.S. This shift solidifies India’s position as the world’s third-largest car market and a future global manufacturing base.

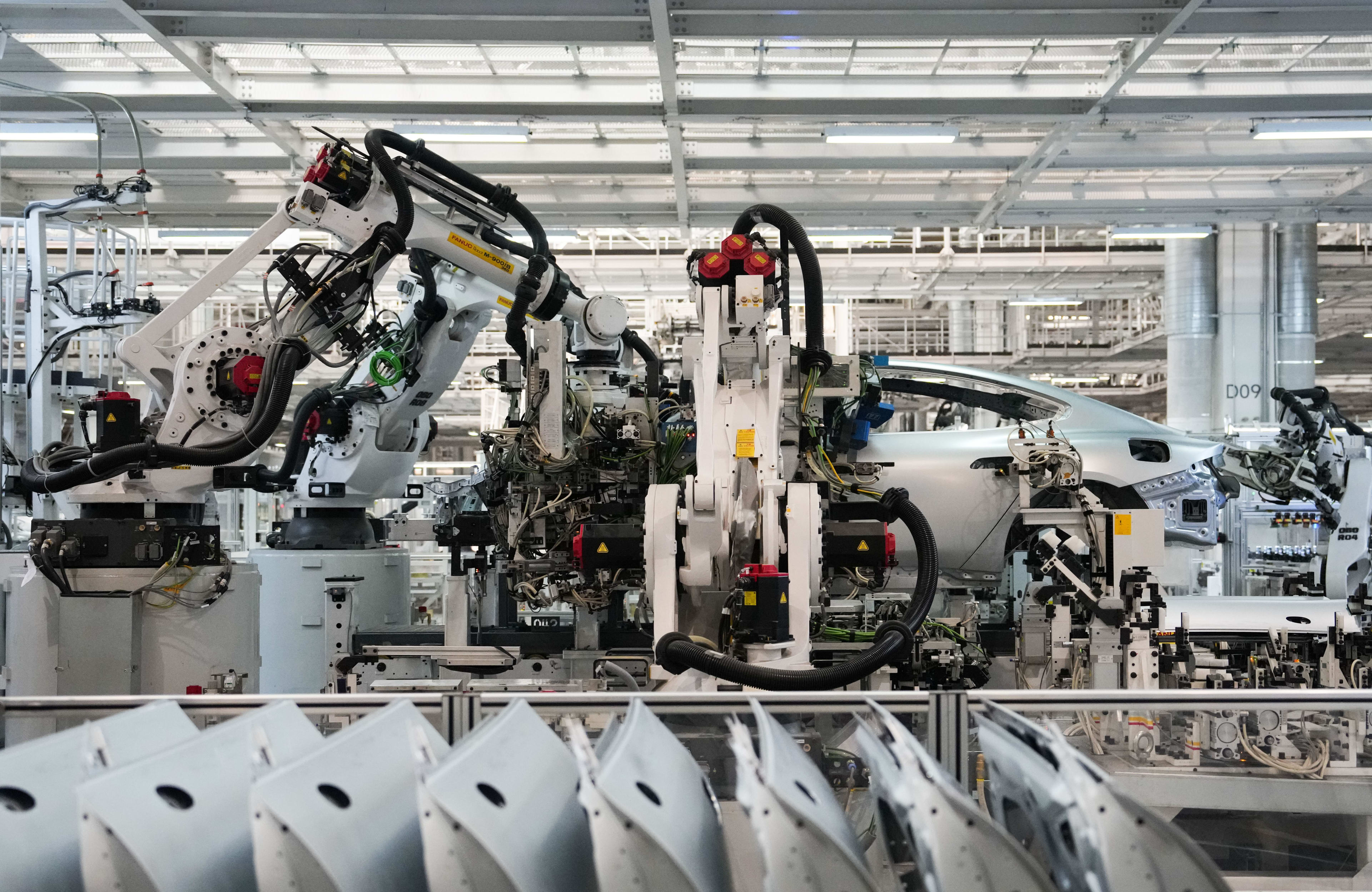

Source: Honda

The Great Pivot: Ditching China for India Automotive Hub

Japanese investment is surging into India while simultaneously shrinking dramatically in China.

- Investment Surge: Japanese annual direct investment in India has risen over seven times between 2021 and 2024, reaching $1.92 billion.

- China Withdrawal: Over the same period, Japanese investment in China dropped 83%, falling to just under $300 million.

- Strategic Rationale: India offers a stable, vast labor pool and protection from Chinese EV competitors who face restrictions in the Indian market.

Aggressive Manufacturing Scale-Up

Japanese automakers are making multi-billion dollar commitments to transform India into a global export hub.

- Suzuki: Investing $8 billion to expand production capacity to 4 million cars annually, up from 2.5 million currently.

- Toyota: Committing over $3 billion to expand its existing factory and build a new plant in Southern India, taking capacity to over 1 million vehicles.

- Honda: Announced plans to make India the production base for one of its planned electric vehicles starting in 2027.

India Automotive Hub: Market Growth and Export Advantage

India’s domestic market growth potential and advantageous export status are key draws for manufacturers.

- Third Largest Market: India has established itself as the world’s third-largest car market, overtaking Japan in 2023 with 4.27 million units sold.

- Massive Potential: With only 44 vehicles per 1,000 people (compared to Japan’s 502 and China’s 251), India has massive room for expansion. The car industry has grown 60% since 2015.

- Export Power: Total automobile exports surged 19% in 2024, reaching over 5.3 million units, driven by strong shipments to Latin America and Africa.

- Crucial Incentive: Passenger vehicles and part exports from India are currently excluded from tariffs in the US, offering a significant competitive advantage for global supply.

Final Thoughts

The over $11 billion investment by Toyota, Honda, and Suzuki signals a definitive pivot toward India Automotive Hub as the primary manufacturing base for affordable, high-volume cars. This strategic shift leverages India’s low costs and strong export status, effectively allowing Japanese brands to compete globally while bypassing geopolitical and cost issues associated with China. For global consumers, India’s emergence as a low-cost manufacturing hub could eventually lead to more affordable vehicles at the dealership.

Also Read – Toyota bZ Lease Deals: 2026 Toyota bZ Lease Deals Available for November, Starting at $399/Month

Pingback: BottegaFuoriserie: Alfa Romeo And Maserati Working Together, But Definitely Not Merging - Mechhelp