Rivian CEO Warns of ‘Existential Threat’ from Chinese EVs but Expresses Confidence Amidst Trump’s Shifting Trade Policies

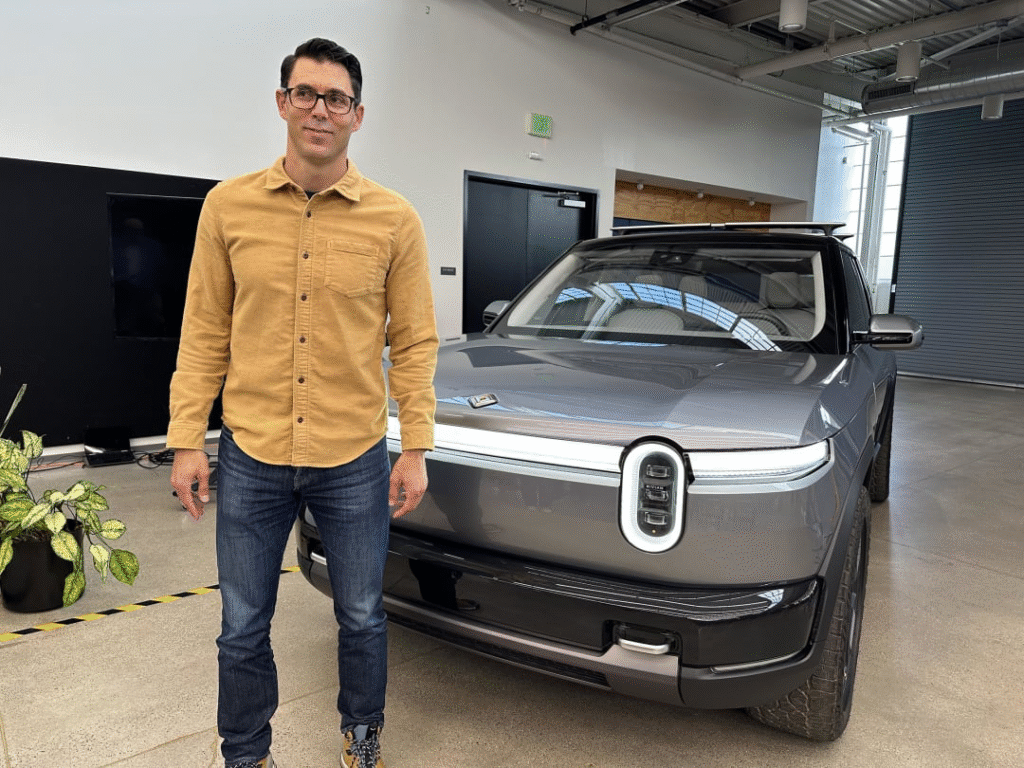

Rivian CEO RJ Scaringe has publicly acknowledged the “existential threat” posed by low-cost Chinese electric vehicles (EVs) entering the U.S. market, a move widely anticipated under the Trump administration. Despite this looming challenge and ongoing skepticism from Wall Street, Scaringe asserts he has “never been more confident” about Rivian’s future. He’s preparing to face brands like BYD and Geely head-on, banking on compelling products like the upcoming Rivian R2 and emphasizing the need for a “level playing field” through tariffs to counter the “structural advantages” of Chinese competitors.

The “Existential Threat” and Trump’s Stance on Chinese EVs

The potential entry of low-cost Chinese EVs into the U.S. market is a major concern for the automotive industry.

- Industry Alarm: Traditional automakers, including Ford CEO Jim Farley, have warned of an “existential threat” from Chinese brands like Geely, BYD, and Great Wall, which an unusual alliance has fought hard to keep out of the U.S. market.

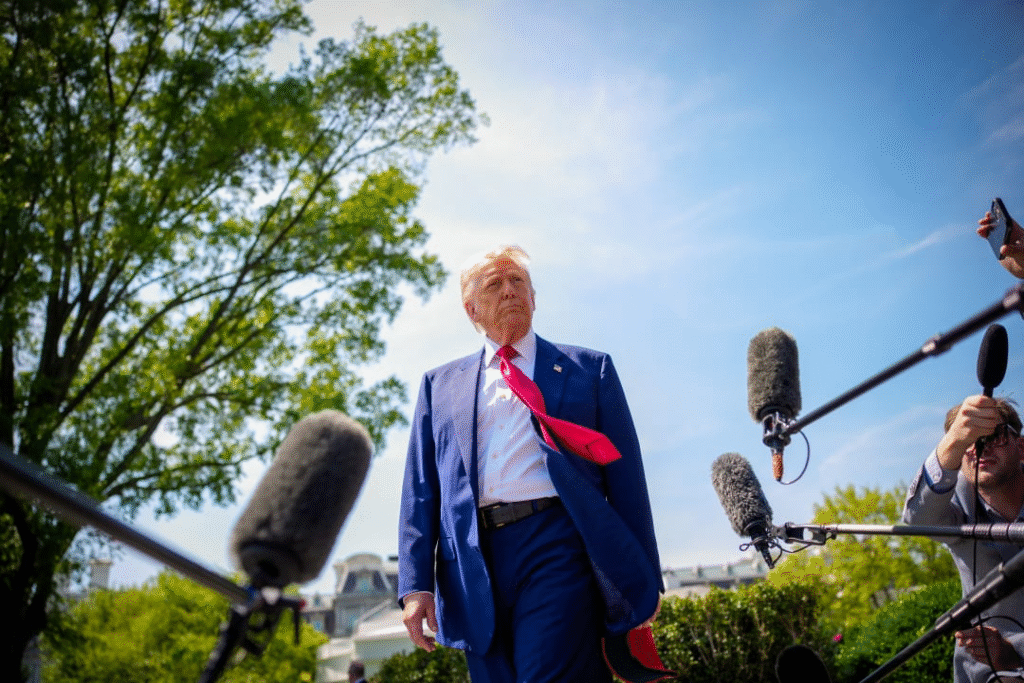

- Trump’s Anticipated Move: President Donald Trump is expected to open the door to these manufacturers as part of a “grand” trade deal with Beijing.

- Rivian’s Preparedness: Despite the widespread panic, Scaringe stated, “It’s conceivable and plausible we’ll have to compete with them,” highlighting his readiness to face the challenge with “compelling” products like the upcoming Rivian R2.

Chinese Automakers’ “Unfair Advantages”

Scaringe and industry analysts like Michael Dunne point to significant structural advantages enjoyed by Chinese automakers, which are not due to technological breakthroughs but rather systemic benefits.

- Explosive Growth: Chinese automakers are projected to export 7.5 million vehicles in 2025, a massive increase from 1 million at the decade’s start.

- Cost Discrepancy: The BYD Dolphin Mini, for instance, sells for just over $21,000 in Mexico, where Chinese brands now control 20% of the market. In contrast, Rivian’s R2 will start around $45,000.

- Subsidized Production: Scaringe argued that Chinese brands benefit from extremely low labor costs, highly subsidized land, loans, and energy. These factors sharply reduce immediate production costs and long-term capital expenditures, translating into thousands of dollars of savings per vehicle.

- Call for Tariffs: To level the playing field, Scaringe believes tariffs are necessary, though he acknowledges uncertainty regarding their implementation and height under Trump.

Rivian’s Alignment with the Administration and Manufacturing Focus

Despite Trump’s skepticism towards EVs and previous rollbacks of Biden-era EV initiatives, Scaringe sees an alignment with the administration through Rivian’s U.S. manufacturing focus.

- U.S. Manufacturing Strategy: Rivian has expanded its Normal, Illinois plant to 6 million square feet to accommodate R2 production by mid-2026 and has secured funding for a second plant in Georgia.

- Battery Production: Rivian has partnered with LG to establish battery production alongside its Illinois plant in 2026, initially importing lithium-ion batteries from South Korea.

- Production Capacity: The “beautifully flexible line” aims for an annual capacity of up to 400,000 EVs, including future R3 models and R2 variants.

- Tariff Uncertainty: Scaringe acknowledged that Trump’s unclear and frequently changing trade policies pose challenges for long-term planning and increase production costs, making it difficult to predict future scenarios.

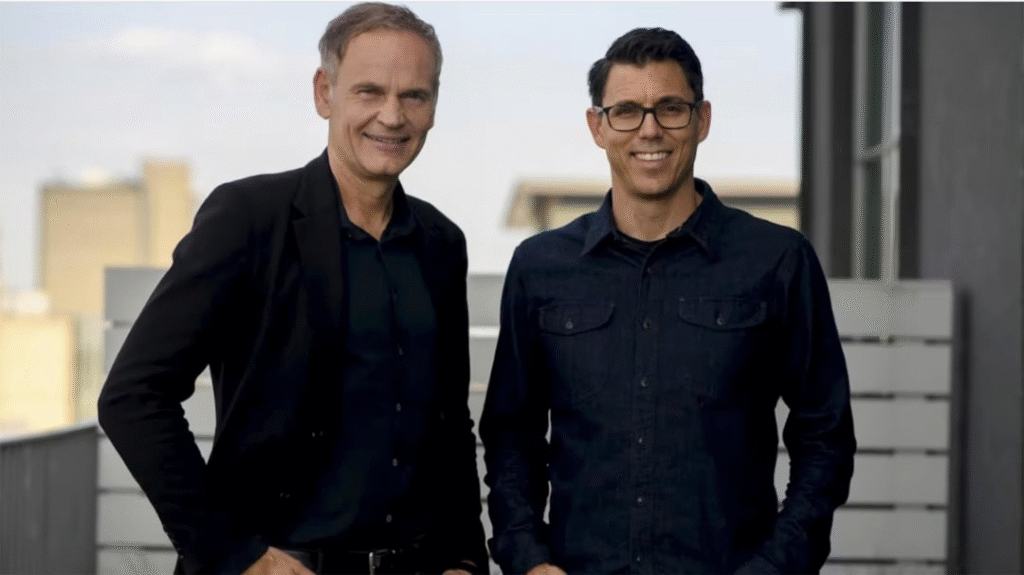

Strategic Partnerships: Amazon and Volkswagen

Scaringe’s optimism is further bolstered by Rivian’s strong strategic partnerships.

- Amazon: A major shareholder, Amazon has already purchased over 30,000 battery-electric vans for its Prime delivery service.

- Volkswagen Joint Venture: Volkswagen increased its joint venture with Rivian to $5.8 billion in November 2024.

- Focus on Software: The initial focus is on software, with Rivian providing its centralized computing technology to VW, which is more efficient than distributed computing.

- VW Integration: Rivian’s technology will debut in the VW ID.1 EV in Europe next year, followed by an all-electric VW Golf for the U.S., and potentially a flagship Porsche or Audi EV.

- Future Expansion: Scaringe hinted at “lots of ways” to expand the relationship, possibly including joint vehicle development or manufacturing in the future, though nothing is currently in the works.

Rivian’s future hinges on its ability to produce compelling, American-made EVs at scale while navigating complex international trade dynamics and the evolving landscape of government policies.

Also Read – 2012 Mercedes-Benz SLS AMG Gullwing with 5,000 Miles: A Pristine Time Capsule Up for Auction

Pingback: Aerfal AE94: The Porsche 914 Restomod That Ignores The 911, Reviving 904 Carrera GTS Spirit With 400-HP Flat-Eight - Mechhelp